The look of marble and industrial chic are highly desirable, especially when they come packaged as a product that can cope with every day living. That’s the promise of engineered stone as it continues to expand the repertoire of stone processors. And there is plenty of it to choose from.

Cosentino says its industrial finishes have become its best sellers, overtaking the white marble look. Once, a change of fashion away from stone towards metal and concrete might have been bad news for stone processors. These days it makes no difference because it is all (in Cosentino’s case) Silestone and Dekton.

Engineered quartz, like Cosentino’s Silestone that leads the UK market, has hugely expanded the granite worktop sector. For many stone processors, engineered quartz from any of the large number of companies now manufacturing it, constitutes by far the larger part of their sales.

And although engineered quartz has led the way, following in its footsteps now are any number of other engineered stone-like products in slab format. Even the makers of laminates are developing new, more resilient products with stone-look finishes.

At the KBB exhibition in the NEC, Birmingham, last month, Formica, the epitome of laminate, previewed what it described as “the next generation of worktop” in a resin-bonded wood-based board product that does not even have a name yet. No doubt Formica will contest the description, but it seems to be a resin version of MDF with a printed plastic surface laminated on to it. Those at KBB had a stone look surface.

The substrate comes in three colours (black, white and grey) that go all the way through it, so if you cut it, it still has the same edge colour.

The substrate comes in three colours (black, white and grey) that go all the way through it, so if you cut it, it still has the same edge colour.

Having had a taste of what engineered stone can deliver, stone processors and the KBB showrooms many of them work with have not been natural stone purists for many years.

There is a sector of the commercial and domestic market that always has and always will want natural stone, but many end users have been convinced by the large sums of money put into persuading them of the superiority of branded man-made products.

None has done it better than Cosentino, which currently has seven depots around the UK and Ireland with two more on the way (one in Belfast, the other in Newmarket) because the current network is becoming stretched. With 96% of the stone processors it supplies getting two or three deliveries a week so they don’t have too much money tied up in stock, logistics are vital to Cosentino.

As well as Silestone, Cosentino makes Dekton, one of the next generation of ultra-compact surfaces (UCSs). These products (others include Lapitec and Neolith) have led to processors investing in waterjet cutting. Once you have a waterjet you can cut a wide range of materials, which has encouraged stone processors to explore even more new product areas.

Being a market leader means Cosentino, with sales topping €900million (more than US$1billion) worldwide, is also a target, and one company that has stated it has the UK’s number one spot in its sights is Caesarstone, which was generally considered to be number two in the British market before it started selling its quartz on its own behalf in the UK from a warehouse inside the M25 last year. It believes it has already regained that position.

It reiterated in this magazine at the start of the year its aim to reach the number one spot, saying it expects to achieve that sooner rather than later.

And it expects to do it by taking sales from laminates, which still have by far the largest share of the worktops market, rather than simply taking market share from other quartz brands.

And it expects to do it by taking sales from laminates, which still have by far the largest share of the worktops market, rather than simply taking market share from other quartz brands.

Caesarstone believes quartz can take market share from laminates because most people, given the choice and no budget restrictions, would rather have a stone-like material as worktops than a laminate.

Quartz, ceramic, ultra compact surfaces and stone itself have reached a critical mass in interiors that has changed their status. They are what people expect to find in kitchens – and increasingly also in other rooms, especially bathrooms.

As long as there is not another full-blown economic crises for a while, a growing proportion of the market will continue to see hard surfaces as a minimum requirement rather than luxuries to aspire to.

And while Brexit is an unknown quantity that is unsettling, the stone industry in general seems fairly sanguine about it. As one supplier said, the market did not collapse when the value of the pound plummeted after the referendum and there is no reason to expect it will after March 2019 when the UK officially leaves the European Union.

While there is no shortage of quartz suppliers hoping to win market share from Cosentino, one of the reasons it leads the market is because it does not stand still.

At KBB it showed its expanded Eternal range, adding five designs that will be available exclusively through the brand’s Elite studio partners.

Inspired by natural materials, there is Classic Calacatta, Desert Silver, Bianco Calacatta, Eternal Marfil and Eternal Emperador. Cosentino says these new designs offer a reinvented take on some of the most sought-after marbles and stones. They all feature N-Boost, a finish that repels water and adds an extra lustre to the sheen.

Silestone is available in three thicknesses, 12mm, 20mm and 30mm, and slab sizes of 3040mm x 1380mm as standard and jumbo sizes of 3250mm x 1590mm. There is a choice of more than 80 colours in three finishes – polished, volcano and suede.

Also on the Cosentino stand at KBB were the latest additions to the Industrial collection of Dekton designs. There are three of them – Nilium, Radium and Orix. They join Trilium, which was launched last year and has become a best seller.

Nilium, Radium and Trilium have what Cosentino calls a hybrid appearance based on weather-worn natural stone and aged metals. Orix combines the degradation of cement with the biological transformation of stone.

The Industrial collection was created in conjunction with top designer Daniel Germani, who says: “The Dekton Industrial colour collection was created so as to contemplate the beauty of metals and cement at every stage of their life. It pays homage to the beautiful imperfections of the oxidation and degradation processes undergone by certain materials. The incomparable technology of Dekton gave us the tools necessary to explore and design. The result is a collection of colours that highlight the richness and depth of natural, organic processes.”

Lapitec is another of the sintered or ultra-compact stones. It is distributed in the UK by stone wholesaler The Marble & Granite Centre based in Rickmansworth, Hertfordshire. The two latest launches in Lapitec are Nero Assoluto and Bianco Assoluto – its whitest white and blackest black yet. This brings to 15 the number of monochrome shades in the range as well as six Arabescato finishes.

Nero Assoluto and Bianco Assoluto come in the standard Lapitec thicknesses of 12, 20 and 30mm and a choice of seven finishes, from luminescent Lux to the more structured and tactile surfaces of Fossil and Arena. As well as worktops, Lapitec can be used for internal and external cladding and indoor and outdoor flooring... in fact, just about anything stone could be used for.

Neolith, meanwhile, has consolidated its position in the UK by opening its own distribution warehouse and showroom in Harlow, Essex, with Shaun Hopkinson appointed as Area Manager and a sales team newly hired. Shaun says: “More feet on the ground will ensure hand-in-hand growth with partners.”

The warehouse opened in February this year and stocks the entire range of Neolith sintered stone slabs in all sizes, finishes and thicknesses.

Neolith also plans to open a showroom in central London this spring where architects, designers and fabricators can see the slabs in finished applications.

The company says the UK is one of its fastest growing markets for both residential and commercial use of its products and that it has opened its own distribution centre because it wants to be permanently represented in this market.

Neolith’s UK Business Development Manager, Marco De Grazia, says Neolith has opened a fourth production line in Spain and had sales worth more than €100million last year. The company “wanted to amplify our sales presence and tighten up our logistics within key territories”.

He says the uncertainty caused by Brexit also influenced the decision. “We’ve no doubt that the UK leaving the European Union will have a considerable impact on businesses across the continent. As [the UK is] one of our biggest export markets, we want to ensure we limit the effects of this eventuality as much as possible to guarantee that we always have the supply ready to meet any increasing demand.”

There are four new designs of Neolith for 2018. Retrostone is described by The Size, which makes Neolith, as a “homage to design-classic terrazzo”. There are three other designs that Neolith says are inspired by the Mediterranean. They are called Mirage, Krater and Calatorao.

Two new colours have been added to the NanoTech polished collection – pale-grey Luna and light-brown Bombón.

Cambria quartz, represented in the UK by stone wholesaler Granite Granite, added five new designs to its Marble Collection at the end of last year – Brittanicca Gold, Brittanicca Warm, Ironsbridge, Delgatie, and Highgate. They bring Cambria’s total palette to more than 145 designs across nine collections, all available in the American manufacturer’s Cambria Matte finish or high-gloss.

The latest launches are warm, neutral colours with large-scale veining. Cambria says the white marble look continues to be in high demand with consumers as a counterpoint to the dark, dramatic tones that are popular in paint colours, cabinetry, appliances, and accessories.

Some processors complain that the veining in marbled quartz does not always go all the way through the material, which can spoil the effect on the edges, but Cambria says its production process means the veining does go through the entire thickness of the slab.

There is no shortage of quartz brands to choose from and with demand for quartz growing and showing every sign that it will continue to do so, J Rotherham Masonry, based in the East Riding of Yorkshire and one of the largest kitchen worktop fabricators in the country, plans to introduce in July a range exclusive to itself called Aurea Stone.

J Rotherham Masonry already uses Gemini quartz, which has become its best-selling worktop range with 40 colours in five distinct collections, including the stand-out Mythology Series that looks like exotic granites. New from Gemini is the matt finished Concrete Series that has a raw, stripped back theme.

The Aurea Stone is described in contemporary digital jargon as “Quartz 2.0”. What that boils down to is a believable marble effect achieved by a translucent depth to the surface on the “brightest and whitest” quartz.

Not that it is just quartz and sintered UDS surfaces that have adopted the look of stone. It is a favourite finish in the increasing range of large format ceramics, such as Sapien Stone, available from stone wholesalers Beltrami in the West Midlands and Gerald Culliford in Surry. The seamless joins of ceramics are an attraction.

There are even a few ceramics made in the UK, such as those of British Ceramic Tile in Devon.

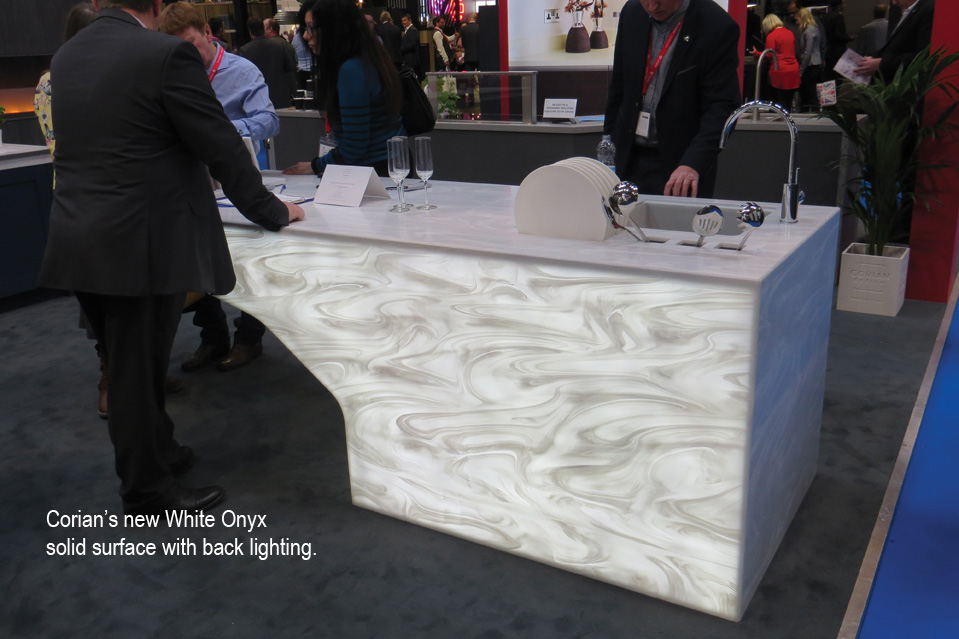

Solid surfaces have not missed out on the marble trend, either. New designs from Corian, the original Du Pont solid surface, include Grey Onyx and White Onyx, with swirling patterns against a translucent ground that can be back lit. Also new this year are Limestone, Dune and Nimbus from the marble-veined Prima collection, Neutral Concrete, Willow (a soft grey and brown) and Graylite and Sparkling White that have reflective particles in them to give the surfaces an added liveliness.

Karonia’s four latest additions to its Mistral 25mm thick worktop range have included two marble-inspired decors called Aria, which has a vein on a sparkling white base, and Moonscape, with swirls of grey and sparkling white.

Commenting on the new colours, Karonia Director Andrew Pickup says: “In surfaces, we have seen sustained demand for marble-look products as well as numerous shades of grey, emulating the appearance of stone through to concrete. Products inspired by nature always tend to have a timelessness built into them and so these current trends dovetailed seamlessly into our approach to colour development.”

New for LG Hausys Hi-Macs solid surface for 2018 is the Concrete Collection, which the company says goes back to the bare essentials, offering the rough texture of raw concrete as well as smooth finish Hi-Macs within the range.

Solid surfaces are not dissimilar to quartz but admite to a higher proportion of resin (about 30%), which means they have always been promoted as being easily shaped using heat in a process called thermoforming. There are special heated tables for carrying out the process. Lately, some of the quartz manufacturers have also been pointing out that their products can be thermoformed, even though they are advertised as containing a much smaller proportion of resin (10% or less).

Solid surfaces are starting to make their way into stone fabrication workshops as old distinctions between different materials are broken down by the allure of a greater share of an expanding market and the mysteries of unfamiliar materials dissolve in the universal solvent of YouTube.