After the shock of Covid-19 the wholesalers of natural and engineered stone are pinning their hopes for 2020 on householders spending their holiday money on home improvements.

Exhibitions play an important role not just in introducing new products and raising the profile of suppliers but also in creating a positive atmosphere that can permeate an industry.

There was just such a positive feeling at the Surface Design Show at the Business Design Centre in London in February and, particularly, at KBB at the NEC, Birmingham, in March.

Although elbow touching had replaced some hand shaking, nobody was wearing a mask or worrying about keeping two metres apart. Then came the lockdown as Covid-19 deaths approached 10,000 a week and the momentum created by the exhibitions evaporated.

Some of the products previewed at the shows to elicit customer feedback were due to be launched in the spring but will now be launched in the autumn, when it is hoped business will be returning to something like normal after children return to school and a new momentum can be generated.

Most of the stone wholesalers stayed open to some extent during lockdown, even if it was only to accept stock already in transit when it arrived. A few fabricators carried on working, which was easier for the small family firms than the larger enterprises. In general, the wholesalers that continued working would only accept visitors by appointment. Some customers wanted their kitchens and bathrooms to be installed, some didn’t.

As the lockdown comes to an end, the few wholesalers that shut completely are opening again and fabricators have returned to work, although many are still making use of the Coronavirus Job Retention Scheme (CJRS) – the furlough scheme – with staff working part-time.

Cosentino stand at KBB, where the company previewed new designs of Silestone and Dekton for 2020.

Cosentino stand at KBB, where the company previewed new designs of Silestone and Dekton for 2020.

Fabricators might have lost some orders but most seem to be going ahead, which has caused a backlog that is keeping them busy. Some are worried about their order books going forward. Confidence will play a big part in the outcome.

That might also depend on the outcome of the Brexit transition period, although fewer people are expressing concern about that now. It seems to be generally accepted that the transition period will end with or without a deal and whatever the result we will all be in the same boat and facing the same conditions, so nothing much will change in terms of business competition.

In fact, some people believe there could be a Brexit premium from both a feel-good factor and, especially if it becomes more complicated or time consuming to buy from abroad, a greater inclination to source materials from UK suppliers.

Sebastian Harris, Director of Derbyshire-based Pisani Wholesale as well as London worktop company Medusa, says: “I’m actually still very excited about working through this.” Just before the lockdown Pisani had recruited Richard Barrett to represent it in the South of England to expand sales in the wealthiest part of the country.

Richard once worked for the original Pisani and after leaving introduced the German Quartzforms to the UK through QF Distribution, as well as running a worktop fabricating business called The Stone Company. Quartzforms has now established its own British company with stock held at a warehouse in Essex.

These are three new designs in the Planet range from Quartzforms, introduced during KBB this year. They are (left to right) Halley, Honey Galaxy and Interstellar Cloud. The names are not exactly planets but Quartzforms had used up all the names of the solar system planets (apart from Uranus, which it has shied away from using) in the initial launch of the range at the Hard Surfaces exhibition running alongside the Natural Stone Show at ExCeL in London last year. Quartzforms is the latest quartz manufacturer to have established its own UK-registered company to sell its products in Britain. It holds stock at its warehouse in Harlow, Essex. The quartz is made at a 120,000m2 factory in Magdeburg, Germany, where there is an efficient road and rail transport network as well as the nearby port on the River Elba.

These are three new designs in the Planet range from Quartzforms, introduced during KBB this year. They are (left to right) Halley, Honey Galaxy and Interstellar Cloud. The names are not exactly planets but Quartzforms had used up all the names of the solar system planets (apart from Uranus, which it has shied away from using) in the initial launch of the range at the Hard Surfaces exhibition running alongside the Natural Stone Show at ExCeL in London last year. Quartzforms is the latest quartz manufacturer to have established its own UK-registered company to sell its products in Britain. It holds stock at its warehouse in Harlow, Essex. The quartz is made at a 120,000m2 factory in Magdeburg, Germany, where there is an efficient road and rail transport network as well as the nearby port on the River Elba.

For CR Laurence, the parent of CRL Stone, which distributes Ceralsio porcelain slabs and CRL Quartz, there was even a bonus from social distancing for the glass side of its business that offset some of the lost business on the stone side. It came from the sale of glass fixing systems that retailers and other businesses have been installing (usually with perspex rather than glass) to create physical barriers between customers and staff.

With non-essential shops being allowed to open again in June, most kitchen studios re-opened and enquiries for worktop materials started coming in. Dave Beckett at CRL Stone says: “The number of requests for samples we’ve had! It’s five times more than normal.”

Requests for samples have included the new ranges CRL Stone introduced at KBB and indicates both a pent up demand and that people do intend to invest in their homes.

The reason Sebastian at Pisani and others are not pessimistic about the recovery from Covid-19 is because there is no underlying economic failure like the one that led to the credit crunch in 2009, so business ought to be able to resume where it left off.

However, that will depend on how many businesses close or contract and how many people lose their jobs – like the 2,500 employed by Travis Perkins, the country’s largest builders merchant. It is closing 165 outlets (8% of its sites) in response to the weaker demand it anticipates for at least two years.

As well as the builders merchants, Travis Perkins owns the Wickes DIY stores, Toolstation, Tile Giant, BSS, and others, all together employing nearly 30,000 people. Most of the closures and job losses will be at the builders merchants and all will be in the UK, none at the group’s 66 Toolstation outlets in the Netherlands, France and Belgium.

There will almost inevitably be more job losses in the industry as the furlough scheme winds down and comes to an end after October. Some fabricators privately admit they have only remained in business this long so employees can continue to receive the 80% of their income they get from the furlough scheme.

Some wholesalers are a bit more cautious than Pisani about the outcome of the coronavirus pandemic, such as Rogerio Moutinho at MGLW in London. MGLW had embarked on a modernisation of its premises that is 80% completed.

Rogerio’s aim is to update the company image and bring it into line with customers’ expectations and the way wholesaling has evolved. “I was so positive for 2020, going fully digital and trying to be as paperless as possible.”

Brachot-Hermant introduces its Uniceramica range, reproducing the look of marble, travertine, granite and basalt.

Brachot-Hermant introduces its Uniceramica range, reproducing the look of marble, travertine, granite and basalt.

The virus might have accelerated the whole world’s use of digital technology. The lockdown would certainly have been different without social media and video conferencing keeping people connected. People who had eschewed the technology before Covid-19 have rapidly adopted it during the pandemic. Quartz supplier Caesarstone says virtual visits to its showroom in Enfield, London, through its website increased 800% during the lockdown.

“It’s mind blowing what’s happening,” says Rogerio at MGLW, who equates the economy to a computer. “I can still be a little optimistic – the virus hasn’t damaged the hardware. But it might have damaged the software. If people are frightened to spend money it can have an impact. Travis Perkins is a big sign to me. Whatever happens it won’t be plain sailing.”

The hit to the national economy of the virus and the lockdown is huge. The UK economy contracted 5% in March and a further 20% in April. The Bank of England has estimated the contraction in the first half of this year at 30%, recovering to a fall of 14% for the year as a whole. Optimistically it says GDP could be back on track by the end of next year. By comparison, the 2009 credit crunch saw the economy shrink by just less than 6.5%.

To help the economy on its way to recovery the Bank cut base interest rates in March to 0.1% and has had two further tranches of quantitative easing – putting £210billion into the economy in March and a further £100billion in June after the May inflation figure was well below its 2% target at 0.7%.

The extra £100billion in June brought the total amount of quantitative easing since the credit crunch of 2009 up to £745billion. That is on top of government debt that reached a total of nearly £2trillion in May after the government borrowed a record £55billion in the month, taking the level of debt above 100% of GDP for the first time since 1963. The low base rate helps reduce the cost of that borrowing for the government, just as it does for businesses and individuals.

As we went to press, the government was also talking about reducing VAT to encourage consumer spending, and cutting employer National Insurance contributions to ease the impact on businesses as employees come off the government’s furlough scheme.

From August, employers have to resume payment of National Insurance and pension contributions for people on furlough that has previously been met by the CJRS.

The reduction of VAT and National Insurance is intended to be temporary and the government has already started talking about increasing taxes to reduce public debt levels when the pandemic is no longer a threat – or at least less of a threat.

A temporary reduction in VAT has the advantage of encouraging people to spend now, while the reduction is in place, especially if the tax might soon go up to an even higher level than its previous 20%.

That should benefit kitchen worktop fabricators and the wholesalers that supply them, most of which take comfort from the fact that many people will not be spending so much on holidays this year and, as they have spent so much time at home, might have become aware that their kitchens and bathrooms could do with a makeover.

The government has also extended the expiry date of planning permissions, so building projects that were delayed by the coronavirus can still go ahead. However, most builders have scaled back their expectations of how many houses they will complete this year and some have already reduced the number of people they employ.

Still, mortgage enquiries picked up quickly after restrictions were lifted, benefiting, no doubt, from the low interest rates (although tracker mortgages are now often coming with a minimum level of interest rate below which they will not go).

As Rogerio at MGLW says, with money being cheap, if someone has enough for a deposit on a house they are likely to buy because money in a bank is earning nothing.

“The telephone has started ringing. There’s an eagerness. The fabricators want to get things done - they want to get back to business. The question is: how many deep scars are going to be left,” says Rogerio.

The ready availability of money could also help buyers of new builds make the decision to upgrade their kitchens from basic laminates to hard surfaces. It is a rare show home these days that does not have hard surface kitchen worktops, frequently quartz, and marble (or marble effect) in at least one of the bathrooms.

Not everyone is buying a new build, of course, but moves into previously occupied premises tend to benefit the RMI (repair, maintenance & improvement) section of construction because people are most likely to carry out RMI work when they first acquire a property and kitchens and bathrooms are a priority.

The biggest of all the stone wholesalers in the UK is Cosentino, which sells the Silestone quartz and Dekton sintered stone it makes in Spain as well as natural stone from its eight depots in the UK which had sales of more than £70million in 2018, 16% up on the year.

The Spanish parent is this year celebrating its 40th anniversary. It earns 90% of its income from outside Spain, with its big expansion coming from the introduction of Silestone quartz in 1990, still its major earner. That was followed by Dekton in 2013, sales of which increased 34% in the UK in 2018 (according to the company’s latest annual report) representing 7.5% of Cosentino’s UK sales.

UK Regional Director Paul Gidley says of the parent’s 40th anniversary: “Having worked for Cosentino for the past nine years, and witnessing its continual growth and expansion, it’s an honour to be leading the UK team at such a pivotal point in the company’s history but also during a global pandemic. What has set Cosentino apart – and always has – is its people-first approach. This mindset ripples throughout the whole company and will be what pulls us through this unprecedented period of time.”

Finally, a word from Brachot-Hermant, the Belgium company with a depot in the UK in Erdington, Birmingham, although it also owns another Belgian company, Beltrami, with its UK depot in Halesown, West Midlands.

In May it extended its range of value-for-money ceramic slabs with its own line called Uniceramica in 10 designs, two thicknesses and three finishes.

The designs replicate marble, travertine, granite and basalt. There is Uniceramica Tajmahal, for example, with a look of travertine. Marmo Antico has accents in grey and brown while Statuario offers the familiar grey veins on a white background. The Bocciardata finish, developed in-house by Brachot, gives Basalto Grigio, a modern grey design, and Nero a striking textured surface. And for a uniform, neutral design there is Nero Assoluto with its black granite look.

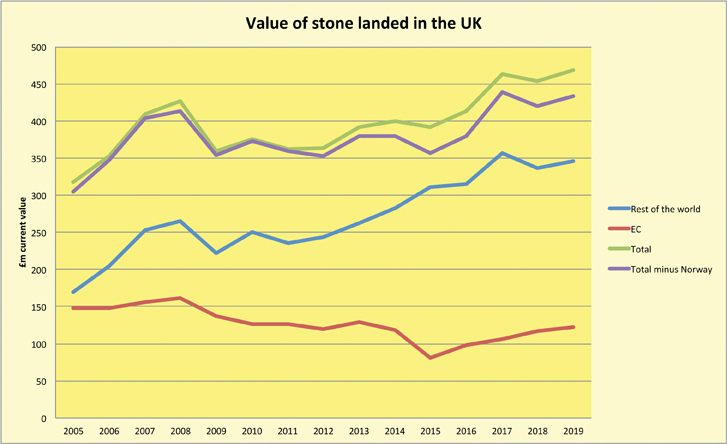

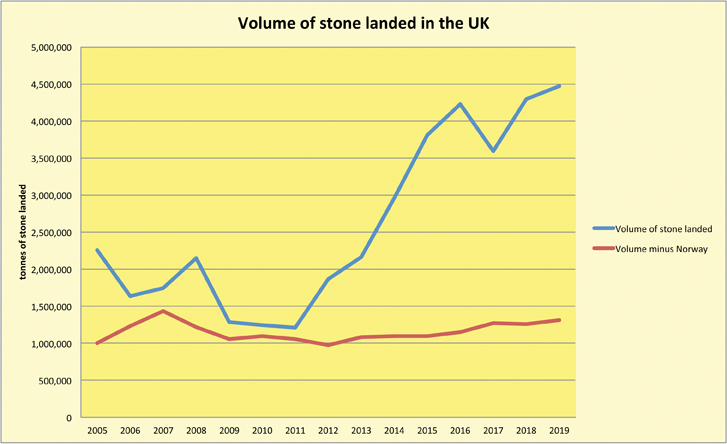

Stone landed in the UK

Nearly all the natural and engineered stone sold in the UK by specialist wholesalers is imported, although those selling memorials and hard landscaping sometimes sell British stone as well, as do some of the stone merchants and builders merchants.

The diversity of uses of stone landed makes it difficult to get a true picture of the value or volume of stone that is actually being used in what would normally be considered the stone industry. For example, there has been a lot of low value granite landed in the UK from Norway. By weight, it accounts for 71% of the dimensional stone landed in the UK but accounts for only 8% of the value. Why? Because most of it is going into sea defences. The computer-generated picture below of the £100million Southsea project in Portsmouth gives an idea of how so much granite can be used.

It is part of a six-year programme by the Environment Agency costed at a total of £2.6billion to protect 300,000 homes in England from flooding and coastal erosion. But the stone used is of large enough blocks to be included in the category for dimensional stone as defined by HMRC.

Not all granite from Norway is used for flood defences, so removing all the stone from Norway from the figures will remove some that is put to other uses, but the graphs below show what a distorting impact projects like this can have on the overall picture.

Even without this particularly large distortion, the stone industry figures are always susceptible to distortion by large projects because the sector uses relatively small quantities of a product with a wide price range. Some large paving projects might require a lot of stone but it will have a lower value than major cladding projects or, say, a lot of house building incorporating granite worktops.

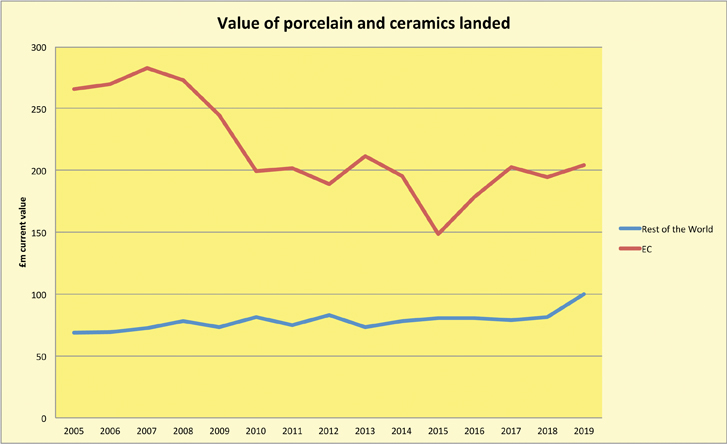

Similar problems of product identification arise with the value of porcelain and ceramics. There are clearly a lot of ceramic products not associated with the stone industry and by trying to filter these out, some products used by stone fabricators are probably lost while others not used by stone companies will get through. Even so, it is clear Europe is currently holding on to the largest share of this market.

And in spite of the difficulties, the figures from HMRC, mostly from VAT returns, provide the best picture we have of the size of the market.

Source: HMRC