Plymouth-based worktop fabricator Mayflowerstone has set a target of doubling its turnover in the next two years thanks to a £600,000 investment in state-of-the-art equipment that includes a waterjet cutter and Robo SawJet.

It has secured the six-figure funding package from Lombard Asset Finance to drive forward its expansion.

The £600,000 finance from Lombard Asset Finance will enable Mayflowerstone to increase the capacity, efficiency and the product quality of its workshop in Plymouth, from where it fabricates granite, quartz, sintered stone, marble and Corian into worktops and vanities for kitchens and bathrooms in domestic and commercial premises. It offers supply only and templating and fixing.

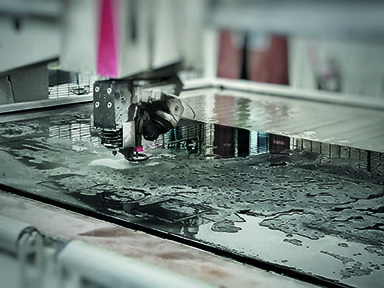

The funding is supporting the company’s investment in its industry-leading equipment, including the American-made Baca Robo SawJet, sold in the UK by LPE, an Intermac Primus 402 waterjet and the latest version of the Breton nc300 CNC workcentre (only the third installed in Europe).

Established in 2006 with two employees, Mayflowerstone now has 63 people working across the group, with recruitment underway for six more to fill new roles created by the latest investment.

Jamie Dowdall, Managing Director of Mayflowerstone, says: “Our ambition as a business has always been to expand and offer our quality products to more customers across a larger area.

“The funding from Lombard Asset Finance will allow us to increase our production capacity by investing in new and improved equipment that will increase the speed at which we can operate and therefore our output.

“This will help us to achieve our goal of doubling the size of the business in the next two years and expanding our existing team.”

Lombard Asset Finance is part of the NatWest bank group that has supported Mayflowerstone’s continued growth since the company was formed. NatWest provided the funding that enabled the company to acquire its current premises in 2016.