Annual Equipment Review: Developments in stone processing machinery

The Donatoni Jet 625 CNC is a compact five axes CNC bridge saw that will be on the Donatoni stand at Marmo+Mac. Italian manufacturer Donatoni Macchine is now represented in the UK and Ireland by new company Stone Automation.

Marmo+Mac, Europe’s major international stone exhibition in Verona, Italy, looks like being busier this year than last year’s Covid-muted event. In the UK, the Bank of England warns of impending recession.

There have been some changes in the stone machinery supply market this year, with GMM buying Bavelloni, Donatoni Macchine moving its UK distribution from Intermac to a new company set up by Salvatore Caruso called Stone Automation and Baca now being represented by KMT Waterjet.

The machinery itself continues to get faster and more efficient, thanks largely to ever more computing power, although priority has been just to get enough machines made to meet demand in the past couple of years.

Shortages of steel, computer chips and components (especially those made in China) have frustrated manufacturers, as have the difficulties in getting ships and containers and the prices having to be paid for them. Delays at the docks, worsened by Brexit, have added to the costs and delays in the UK. And on top of it all dock workers at Felixstowe went on strike in August for the first time in 30 years. They were on strike again, this time joined by Liverpool dockers, this month (September).

The rising costs of fuel are taking their toll as well. It is not just adding to the cost of moving materials around, it impacts input prices at factories. As James Turton at New Stone Age points out, the surge in energy costs have consequences people do not even consider – like for the ovens used to cure the paint on machinery.

At least the government has promised industry a price cap like that for consumers, albeit for six months only, at least initially, once the government has figured out how it is going to work.

In spite of the difficulties, machinery manufacturers and their representatives in the UK and other countries have enjoyed high levels of sales in the past 30 months, helped by low interest rates and government-backed loans.

Roccia Machinery, which sells Italian GMM saws and waterjets in the UK, is not alone in saying this year is going to be a record-breaker. Mark Brownlee at Accurite puts it this way: “It’s better than any period I can ever remember.”

Much of the stone industry’s machinery is made in Italy and the Associazione Italiana Marmomacchine (AIM), the trade association of Italian stone machinery manufacturers, reports an increase in exports in 2021 of 18.5% compared with 2020, although 2020 had seen a significant fall in sales in spite of the pick-up in the second half of the year. Compared with 2019, sales in 2021 were up 0.3%. According to AIM’s Studies Center, sales for the first quarter of 2022 were up a further 3.4%, and it could have been more if companies had been able to make more.

With sales worth €52.9million, the UK was the Italian’s fifth largest export market, behind the USA, Spain, Poland and Germany, in that order.

For stone companies in the UK, the cost of materials, labour, property, energy, fuel and services are all increasing, while in order to remain competitive the prices firms can charge for their goods and services cannot always reflect the full extent of those increases.

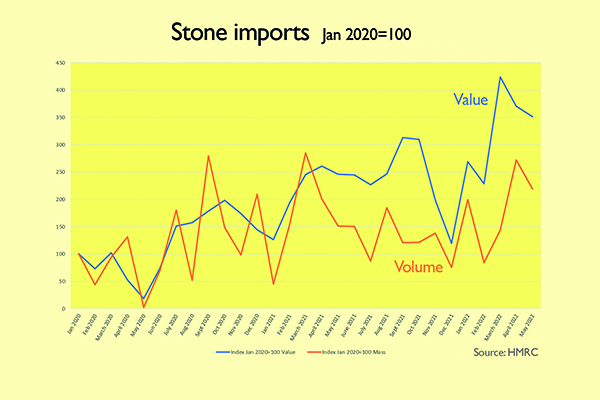

HMRC figures for volumes and values of stone imports (see the graph above) show the gap between them, indicating prices of imported stone are rising. Stone imports are still relatively small so peaks and troughs are exaggerated by monthly variations, but the trend is clear.

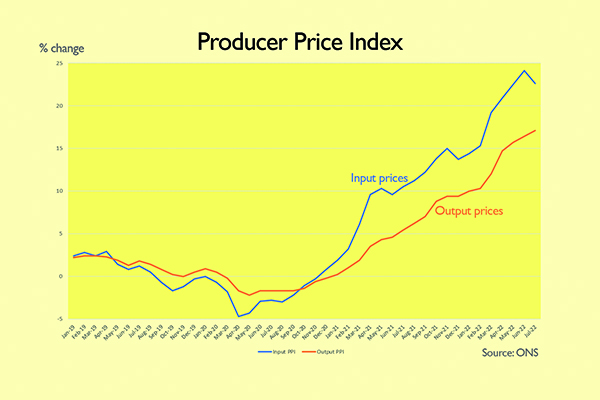

The all industry Producer Price Index recorded by the Office for National Statistics tells the same story of input prices rising faster than output prices. Input price increases did ease in July along with fuel prices, but were still well ahead of output price increases.

On the plus side, many stone companies should be in a good position to absorb some of the rising costs thanks to the high levels of investment in new machinery in the past two years. Initially interest-free government-backed loans that were available to firms from schemes such as the Coronavirus Business Interruption Loan Scheme (CBILS) and the Bounce Back Loan Scheme (BBLS) stimulated that level of investment.

CBILS and BBLS are now closed to new customers, although the Recovery Loan Scheme (RLS) has been extended again. Launched in April 2021, RLS was intended to run until the end of that year, but was extended first for another six months and now until the end of August 2024. And the requirement for borrowers to show they have been affected by Covid has now been dropped for most loans.

Up to July this year, more than £4.5billion had been lent to 20,600 smaller businesses across the UK through RLS.

The temporary capital allowance super-deduction, giving tax relief on 130% of the price of capital investments, has also encouraged firms to invest now rather than waiting.

Introduced in the 2021 Spring Budget, the super-deduction is due to end with March in 2023, and the Chancellor, Kwasi Kwateng, did not mention the super-deduction in his 'fiscal event' on 23 September, so presumably it is still ending with March next year. However, he said the £1million threshold for the Annual Investment Allowance will be maintained instead of being reduced to £200,000 as previously intended.

The intention had also been to increase Corporation Tax from 19% to 25% at the same time as the super-deduction ended, but that idea was scrapped in the fiscal event and it will stay at 19%.

There was other good news for business in the fiscal event. This year's temporary 1.25% increase in National Insurance, which some described as a tax on jobs, is being brought to an end on 6 November and it will not be making a come-back as the previously proposed Health & Social Care Levy in April next year.

The 2017 and 2021 changes to IR35 off-payroll working rules are being repealed as well, which will please many as they are chaotic. From April, workers providing their services via an intermediary “will once again be responsible”, said the Chancellor, for determining their employment status and paying the correct tax and National Insurance.

The Chancellor confirmed the Government is in early discussions to create 40 ‘investment zones’ that actually cover most of England. They will offer a freeze on rates for businesses moving on to the sites and no National Insurance on the first £50,000 a new employee earns. There will be no stamp duty on the purchase of land on the sites, either.

The investment zones are presumably in addition to the free ports the government announced under the ‘levelling up’ programme to alleviate some of the difficulties associated with Brexit, although free ports were not mentioned by the Chancellor on 23 September. The government also plans to publish a list of infrastructure projects it will support.

Income tax was also cut. The top level was reduced from 45% to 40% and the bottom level from 20% to 19%. And the Chancellor confirmed that business would get a cap on energy prices in line with those being given to consumers, although for firms it is for six months (with the possibility of that being extended) while consumers have been given a two-year cap.

Stamp duty on housing is being cut, which will offset some of the increase in the cost of mortgages due to the Bank of England raising the base interest rate on 22 September (the seventh increase since December) putting it at 2.25%. More increases are expected in the months ahead.

It is unusual to see the Bank of England monetary policy to reduce inflation being at odds with the government’s fiscal policy to stimulate demand, and many economists are interested to see if what is already being called Kwasi-economics can deliver both growth and lower inflation.

As the interest rate was increased the day before the Chancellor's fiscal event, the Bank of England's Governor, Andrew Bailey, warned of impending recession in spite of inflation expected to go well over 10%. However, the Chancellor said the day afterwards that the fuel subsidies, which could add an extra £200billion or so to the country's already record debt, would knock five percentage points off the level of inflation reached.

Whatever the future holds, the past 24 months have seen a lot of stone companies investing in new machinery, and a lot more UK companies this year say they are going to visit Marmo+Mac in Verona on 27-30 September than went last year, when there was considerably more concern about Covid-19.

The dates this year are Tuesday to Friday. The show has previously ended on a Saturday, when most of the visitors are local, but that has been dropped this time.

Even some of the UK machinery agents, who normally support their principals in Verona every year did not go last year, although they are planning to attend this year and will be available to speak to English-speaking visitors.

One British company that did exhibit last year is LPE Group, and it will be back in Verona this year showing the American Laser Products’ templaters, OmniCubed materials handling equipment and BVC vacuum cups (BVC stands for ‘better vacuum cups’).

The big news from Laser Products, the American manufacturer of laser templating devices, is the new LT3 Raptor software. It comes after the retirement of Dan Lewis, the Laser Products owner, last year and the company being bought by Josh Hulburt, who was at one time a fabricator on the West Coast of the USA, although he sold that business some years ago.

Under the new owner, the Laser Products development team has been increased from three people to 10 and the new software has been written. It is due to be launched in America two weeks before Marmo+Mac, with Marmo+Mac being the first time it has gone on general release in Europe. It will be on show on the LPE stand.

During its development some Laser Products customers, including some in the UK, had soft-launch versions to ensure there were no unforeseen problems with it.

Its big advantage is that it is quicker. How much quicker will depend on the proficiency of the templater using it, but it could mean an extra kitchen templated each day.

Built from the ground up, it provides software stability with Windows OS and subsequent updates. A faster processor, with Bluetooth connectivity, means points are captured without a lag.

There are numerous improved functions, such as the enhanced Quick-Actions menu that makes it even easier to add and organise frequently used functions like offsets and fillets. There is an integrated TeamViewer for more advanced remote technical support and visual notification to alert the operator of templating errors in real-time to ensure error-free drawings.

Carl Sharkey, who heads the British-based LPE Group, says he showed the LT3 Raptor to 10 companies ahead of the launch to gauge their reaction and they enthused so much to their colleagues in the industry that another 15 companies have been in touch to ask about getting it.

One product LPE Group will not be exhibiting at Marmo+Mac this year is a Baca robot arm with a cutting disc and waterjet. Carl says he has probably sold as many as he is going to in the UK and is now working once again with Italian machinery manufacturer Breton.

Carl once ran Breton UK, but in 2017 split with Breton, which set up its own office in the UK. But Carl had been successful selling the machines and many of those who had bought them continued to contact LPE Group for spares and services, so now LPE Group is once again selling Breton’s undeniably well-respected stone processing machinery in the UK.

Baca is now represented by KMT Waterjet, which has centres in America, Germany and China, and says it is establishing a new company called KMT Waterjet UK. The current contact for the UK is Marketing Director Wolfgang Emrich on Wolfgang.Emrich@kmtwaterjet.com / 0049 170 452 2669.

KMT Waterjet is now the single point of contact in Europe and the UK for all Baca Systems’ parts, price quotations and sales orders. Many spare parts are immediately available.

The Robo SawJet is a six-axes programmable saw and abrasive waterjet cutting system. It incorporates lean industrial machine technologies and an intuitive operator interface, where cutting paths are generated with a few clicks of a mouse.

Its compact footprint means it requires less space than many saws and its combination of a 20kW direct-drive circular saw for straight cuts and the precision of waterjet cuts for angles and arcs, including tap holes, attracted attention among worktop fabricators. Baca also has a water filtration and recycling system called Pure.

Baca Systems President Kevin McManus says: “We are excited to be able to provide our customers in the United Kingdom and Europe with the ability to get the spares and service parts they need more quickly.

“Affording our customers easier access to parts and shorter lead times by working directly with KMT Waterjet, will enable them to better maintain and support their Baca Systems equipment over the long run.”

KMT Waterjet Systems is a manufacturer of UHP waterjet pumps and components that are integrated into complete waterjet systems through partnerships with a global network of Original Equipment Manufacturers of waterjet machines.

Jeremy Sweet, President of KMT Waterjet, says: “KMT is pleased to support Baca Systems with navigating the Brexit rules in the United Kingdom as we have an established regional office offering our customer service team, aftermarket parts, and field service engineers to provide assistance to end customers.”

Kevin McManus says Baca’s technicians can log into customers’ computers to troubleshoot any issues arising. He says Baca has “highly skilled field service technicians that can be dispatched as necessary to help our customers avoid costly downtime”, although he adds: “We’re proud of the fact, however, that the great majority of customer service requests are resolved remotely, without requiring a site visit.”

Not all Marmo+Mac exhibitors had finalised exactly what they would be showing on their stand in August, not least because much of Italy goes on holiday in August. Last year the holidays were cut short for many. This year most had returned to the normal month off.

It still was not clear, for example, whether any Bavelloni machines would be making an appearance on the GMM stand now that GMM has taken a controlling (52%) share of Bavelloni SpA, creating a group with international sales that exceed €100million.

GMM, represented in the UK by Roccia Machinery, is based in Gravellona Toce in Italy. It is a leading manufacturer of machinery for stone cutting, milling, and polishing. These days it also makes edge polishers, as a result of the acquisition of Cemar in 2009, and waterjet cutters following the acquisition of the Australian Techni Waterjet in 2018.

In the past five years GMM’s turnover had grown from €36million to €70million, 85% of which is generated outside Italy.

Joining forces with Bavelloni introduces Bavelloni CNC workcentres to the GMM stable, which could mean the Bottero Practica Plus workcentres that Roccia has been selling in Britain will be replaced by Bavellonis in the Roccia offering.

For Bavelloni SpA, based in Lentate sul Seveso in Italy, a strategic development plan started in 2015 has resulted in an increase in turnover of 75%, including integrating a tools business into its product range.

GMM and Bavelloni will, between them, employ 400 people and operate six production plants and eight direct subsidiaries. The plan is to integrate the respective technologies of the two companies into an annual production of over 800 machines for three main business sectors: Stone with the GMM brand; Glass with the Bavelloni brand; Fabrication under the Techni Waterjet brand.

For Bavelloni, the partnership with GMM opens a new opportunity to develop the stone side of its business in the machinery and tooling sectors, having previously concentrated on the glass industry. Nevertheless, its NRG series of stone processing CNCs, available in three, four and five axes configurations, have their UK proponents.

One product you will definitely be able to see on the GMM stand is the monobloc Extra 480. It has a 370DEG rotating head that tilts to 90DEG. A tilting table (0-85DEG) is driven by a hydraulic cylinder with its own dedicated power unit. The head carries blades up to 625mm DIA. It has a vertical stroke (Z axis) of 480mm and the X and Y axes are 3750mm x 3250mm, respectively.

It is fast and accurate, thanks to brushless motors with recirculating ball guides – helical rack & pinion comes as an option – and precision gearboxes.

There is also an option of a 6000rpm electrospindle with a shaft drilled for water delivery, while a 1450rpm 13kW spindle and a 4kW side spindle for drilling holes come as standard. Water consumption at 3bar is 40 litres per minute.

The vacuum system has three sections and there is a four position magnetic tool changer for core bits and router tools.

To control it all is a new 21in LED colour touch display with integrated machine controls, programming and control unit, a USB port, LAN connection and a remote service system.

The Extra 480 comes with tool diameter control for easy setting up and a slab thickness reader.

More surprising for most was the change of distributor in the UK and Ireland for Donatoni Macchine. Donatoni saws, the best known being the Jet, have been sold by CNC workcentre company Intermac since the two formed an alliance just ahead of the Marmo+Mac stone exhibition in 2015.

Intermac has always said sales had increased considerably since it added the Donatoni bridge saws and Montresor edge polishers (it bought Montresor in 2017) to the machines it was selling because it meant it had the whole package for worktop fabricators.

But Donatoni has decided to move its distributorship in the UK and Ireland to a new company called Stone Automation Ltd set up by Salvatore Caruso (of Classico Marble and Italian Luxury Surfaces in Langley, Berkshire).

Donatoni said the distributor arrangement with Intermac ended on 25 August and Stone Automation’s began on 1 September. Intermac and its parent, Biesse, said they had no comment to make about the Donatoni decision.

By the way, Donatoni Macchine should not be confused with Donatoni Costruzioni Meccaniche, which is represented in the UK by D Zambelis.

Salvatore Caruso, who has worked in the stone industry for more than 30 years, has purchased four Donatoni Jet625 CNC saws for his own business and says his high opinion and working knowledge of Donatoni saws, as well as his existing UK distributorship of stone tooling by Wodiam, meant he was a natural candidate for the Donatoni UK and Ireland distributorship. Having gained it, Salvatore set up Stone Automation Ltd to facilitate his stone technology distributorships.

Donatoni said its focus is the service structure and fast delivery of spare parts across the UK and Ireland, and Salvatore says he is going to make Donatoni “number one for service” because, as a fabricator himself, he knows waiting three hours for a call back when there’s a problem hurts.

Luca Donatoni says: “The search for a new partner for the distribution of our products in the UK and Ireland had to represent something new in the market... Our choice of Salvatore Caruso, owner of Classico Marble, a Donatoni customer, who is already involved in the distribution of other items, seemed to us the most correct choice. We are happy and very confident for the future.”

Intermac, part of the Biesse Group, will still have a major presence at Marmo+Mac, showing its machining centres, cutting processes integrated with handling systems, sheet storage systems, waterjet cutting systems, and a horizontal edge polisher.

And tool-maker Diamut, also part of Biesse Group with its tools sold by Stonegate in the UK, will be showing its re-engineered diamond tools that now have no cobalt in the binder, instead including metal powders with low environmental impact that are harmless to health. Cobalt-free binders mean the waste from machining natural stone is now inert, so should be less expensive to dispose of.

The D Zambelis team will be at Marmo+Mac supporting the manufacturers of the machines they sell in the UK – Achilli, CMG, Donatoni Costruzioni Meccaniche, Omag, OMGM Bellani and Terzago.

They will also be on the stands of Dal Forno, which makes vacuum lifts, Giacomini (cranes) and Italmecc (water recycling and air filtration), all of which D Zambelis also represents. And they will be happy to handle enquiries about CNC tools, bridge saw blades and chemicals. If you want to meet up with D Zambelis in Verona call 07891 484806.

On the Achilli stand you will see the latest bridge saws, bench saws, floor grinders and slab trolleys, alongside the popular four axes Gold CNC bridge saw, complete with tilting table and variable speed motor. It will be in the company of the MBS C TS CNC saw, MSA mitre saw, TFM motorized saw and TOP multipurpose machine.

CMG makes the Taurus bullnoser as part of its robust edge polisher range for convex, inclined and flat edges. The Taurus is customisable, so it can include pre-cutting and calibration units and chamfer units. It features the latest automatic lubrication system.

OMGM Bellani also makes edge polishers, from flats to advanced. The Linea has proved particularly popular. It is a flat-edge polisher with eight heads and two upper and two lower bevels. It is compact, making it ideal for any size of factory.

On the Donatoni Costruzioni Meccaniche stand will be displays of the automated processing lines for splitting, trimming, polishing and palletising stone that the company has been making for more than 60 years. They will include the popular cross-cutting machine, the DM1X.

All the lines are fully customised to customers’ specific needs to improve productivity and reduce labour costs.

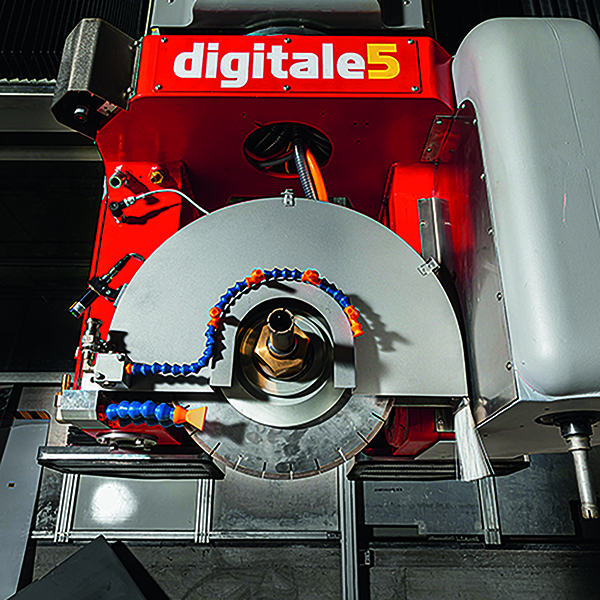

Omag is a heavyweight among stone machinery producers and its stand will feature the Area5 Advanced fully customisable milling machine for masonry work and the Digitale5 monobloc bridge saw. It will show CNC workcentres and waterjets, all using the latest mechanical technology and advanced software.

The Digitale5 is particularly popular in the UK. It comes complete with a camera for vein-matching, suction pads to move workpieces, and probes to measure material thickness and tool dimensions for maximum cutting performance.

On Terzago’s stand, the bridge saws will include a UK favourite for several years now, the CUTe interpolated four axes saw with 1/2in gas CNC tool connection.

Terzago has been making primary and secondary saws for cutting stone for more than 100 years, with its longevity speaking volumes about the quality of its products. Its range covers the spectrum from cast-iron block cutters carrying blades of up to 3.5m to CNC bridge saws like the CUTe.

What else to look out for? The three-pad VL3L pneumatic lifter on the Dal Forno stand; bridge, derrick and gantry cranes from Swiss company Giacomini; and from Italmecc the BCM 11 water recycling system with filterpress and the Air Dry 330 suction cabin for dry technology dust collection.

Mark Brownlee of Accurite will be back on the Denver stand at Marmo+Mac this year after deciding not to attend the exhibition last year. Diamond tool-maker Vetro, which represents Denver in Ireland (north and south of the border) will also have representatives on the stand.

Denver is featuring 10 machines carrying out live simulations during the fair. The machines include the Quota Stone 3350 CNC workstation, Formula and Tecnika CNC saws, the new four-axes Action monobloc saw, and the Unika CNC complete worktop manufacturing unit.

All Denver’s machines now sport the new livery introduced last year and incorporate the changes necessary to accommodate porcelain / sintered surfaces. All the CNCs also have the new DDX software, which an area of the Denver stand will be dedicated to, so you will be able to see for yourself the benefits of its various interactive features.

Accurite has pre-purchased some of the saws and miller-routers you will see on the stand, so they will be available for the UK’s pre-Christmas rush. They will join the five-axes Formula that Accurite already has as a demonstration machine at its headquarters in Cumbria.

And more demonstration machines are planned. Mark Brownlee says: “It’s one thing a customer coming to see a machine, a step up is to see it simulating, but the ultimate is for the customer seeing the machine actually being worked in a factory environment. And this is what we’ve introduced.

“A particularly good example is our edge-polisher – customers can bring their own particular materials and see how the machine polishes them – an actual reflection of what will happen in their factory.

“As you can imagine, since we introduced this a couple of years ago due to Covid, it has really taken off, and most machines, if they’re unfamiliar to the customer, are now sold in this way.

“It has caused quite a stir among tooling suppliers who, as the word spreads, are asking us to use their blades, polishing pads and other tools and equipment on the machine demonstrations.”

The Formula currently in the demonstration area in Cumbria is the latest of Denver’s five-axes machines. Mark Brownlee has high hopes for it. It is simple to operate and stacked with standard feature options, including vacuum piece movement, a rubber cutting surface, hydraulic tilt table and enlarged bed. It is fast and has a price tag Accurite believes will make it particularly popular.

Another Denver machine being shown at Marmo+Mac and already in stock in Cumbria is the Vision, for face polishing and texturing.

It has become increasingly popular over the past few years as more companies add bespoke finishes to standard materials. The latest software can identify irregular shapes, making it even easier to hone, bush-hammer, leather and antique, as well as polish.

After Brexit, Accurite increased the number of machines and level of spares it stocks in the UK and in 2023 expects to have more than £1.5million-worth of machinery in Cumbria keeping lead times short.

“The market has changed and evolved quickly over the past few years, particularly with Brexit and Covid,” says Mark. “Customers are no longer prepared to wait 6-12 weeks for machines. If demand is there, our customers need to take advantage of this immediately, not in 6-12 weeks’ time.

“By having large stocks and the forward planning of future orders, both our suppliers and customers get what they want.”

Lately Accurite has extended its factory to gear up for dealing with the refurbishment of more used machines. Mark says if the economy does now contract, the demand for refurbished machines is likely to increase and he wants to be ready.

New Stone Age, widely known for the BM and BV-Tech saws and OMEC Water treatment plant it sells, will be back at Marmo+Mac this year.

Unprecedented demand for new machines from the companies New Stone Age represents are tempered by the same supply chain challenges everyone else is facing. It was also a challenge during the lockdowns getting technicians for installations, although New Stone Age says it was able to overcome these difficulties.

It says demand remains strong in the UK for the machines, despite the ‘noise’ of a downturn.

New Stone Age says some of its customers recognise demand for indigenous stone products could be driven by customers wanting a more local and ethical product, which in turn is driving demand for machinery.

And because some of the machinery required was different from what New Stone Age has been supplying, it has started new collaborations with machine manufactures MD Dario, which makes small vertical wire saws used for tasks such as shaping granite kerbs, and Dazzini, the manufacturer of quarry wire saws and chainsaws. Both companies will be at Marmo+Mac.

BM continues to be one of the world’s major manufactures of traditional frame saws, monoblades, monowires and multiwires, and in Verona will be showing a two column Kodiak 26 Evolution MultiWire.

Many customers in the UK are choosing monowires as slabbing saws, although New Stone Age says there continues to be a demand for the BM monoblade disc cutters – the BM Super and BM Super 800 – alongside the BM Monofil single wire saw.

Both blades and wires have their advocates. A monowire is usually considered quicker than a monoblade but New Stone Age says there is little difference in productivity between the BM Super 800 and a Monofil.

Advocates of the monoblade say it is more accurate than a wire and has a lower operating cost, lower tool costs and lower consumable cost (no rubber linings and guide wheels).

New Stone Age says it is also installing a second multiblade frame saw, a BM15 (with a 1500mm wide frame), this year. Despite the initial installation costs of the foundations, over the life of the machine the cost per square meter of cut is low. And the accuracy and cleanliness of the finish is exceptional in medium-to-soft sedimentary stones.

BV-Tech will be showing a CALBV/600M 1 + 2 calibrating and honing machine at Marmo+Mac that is destined for one of the New Stone Age customers processing sandstone, ashlar and paving. It will be joining other BV-Tech machines at the company, including block cutters and processing lines. The new machine will complete a third processing line for honing ashlar.

Other BV-Techs New Stone Age has supplied this year include a TBV/1600–4MG automatic block cutter and an FTB/1600–4MG multi-bladed 1600 automatic bridge saw with 8m of rail. The IBV/600 automatic heading machine also remains popular. It is available in widths from 600–1500mm and can cut material up to 300mm thick.

Of the new brands represented by New Stone Age at Marmo+Mac, Cortan will be showing surface texturing machines for flaming, bush hammering and sand blasting and MD Dario is exhibiting various configurations of its SET vertical wire saws and the MDX SN44 robot arm saw for cutting and shaping stone up to 250mm thick. New Stone Age is currently supplying a SET400/SV3 vertical wiresaw to a customer in Scotland.

Dazzini is exhibiting a chain saw on a backhoe for squaring blocks. It will also have a PD 1500, which claims to be the only transportable diamond wire saw to have a protected diamond wire circuit, making it practically a mobile monowire.

Stone Equipment International will be at Marmo+Mac supporting Emmedue and Marmo Meccanica, which have stands next to each other in Hall 3.

Stone Equipment International Managing Director Andy Bell says the Emmedue Astra Pro saw has been particularly successful in the UK as an economical alternative to a five axes saw.

The Astra is a three-plus-one axes saw. It can do most of what a five axes saw can do, although it can’t cut circles. Andy maintains that as most stone companies do not want to cut circles, it is not worth their spending an extra £20,000-£30,000 on a five axes saw. And plenty of his customers seem to agree with him as he says he has already sold 11 of the Astras this year.

The Astra comes with an 18HP motor, 3400mm x 1900mm stroke, inverter on the motor to adjust the speed up to 3,000RPM for economy and cutting difficult materials such as sintered stone/porcelain, a head that rotates automatically through 0-90DEG and can be manually tilted for angled cuts, a hydraulic tilting table that can be manually turned and locked in any position required, and a laser. Installation and training is included.

If you want to see one, it will be on the Emmedue stand at Marmo+Mac alongside a Discovery five axes bridge saw, a Globo 850 (a five axes machine that can be a saw and a miller-router), and the Contor 360 CNC workcentre.

On the Marmo Meccanica stand there will be five edge polishers on show, including a prototype LCH 711 that is specifically for working with ceramics/sintered stones.

It will be alongside an LPZ 8221, an LCG 833, an LCV 722 and an LCV 711.

The machines give an indication of the range available from Marmo Meccanica – but only an indication because there are variations covering all requirements.

In the UK, Andy says most of the machines he has sold lately have been top of the range rather than entry level versions, possibly because demand for worktops has been so high that companies have been looking for machines that can increase productivity rather than trying to save money on the purchase price.

An attractive proposition from Stone Equipment International has always been that it offers generous part-exchange deals on new Marmo Meccanicas, because it has its own workshops for refurbishing the used machines.

Stone Equipment International also started increasing its stock levels of Marmo Meccanicas during the Covid pandemic because lead times on machinery were lengthening and when people need a new machine they tend to want it quickly. With 15 of the most popular machines currently in stock – like the LCR for flat edges and pencil rounds – machines can be delivered in a day or so rather than waiting for what can now be months for them to arrive in the UK from overseas. Andy says by January next year he will have 20 Marmo Meccanicas in stock.

After more than 30 years in the stone industry, he says he finds it gratifying that people he has dealt with for many years are now starting to introduce him to the next generation entering the industry, and that Stone Equipment International is still being recommended for providing the solutions needed.

Stone & Glass, which will be at Marmo+Mac in support of CMS Brembana CNC workcentres and waterjets, Sasso, best known for its edge polishers although it also makes other machinery, and Bovone edge polishers.

Stone & Glass has lately merged with engineering company Total Plant Analysis based in Shropshire. Total was set up by engineer Darren Oakley in 2007, the same year Phil Birchall started his business, which has become Stone & Glass, originally selling used machinery to the glass industry.

Darren is moving into the Stone & Glass premises in Bridgend, Mid Glamorgan, and becomes Chief Operating Officer of Stone & Glass, with Phil remaining Chief Executive Officer. The two men have known and respected each other for many years.

The merger gives Stone & Glass Total’s four engineers. “We got fed up looking for engineers,” says Phil, and the merger solves the problem. At the same time, Phillip Haith, who has a long history of selling Brembanas, originally in America, joins the Stone & Glass team on the sales side.

CMS is promising something new and exciting from Brembana in Verona but wants to keep it under wraps until the show.

Stone & Glass says it deals with more individual companies in the stone industry than it does in the glass industry, although each glass company spends more. And Phil Birchall says a particular selling point on the Brembanas is the spindle exchange, so when a spindle needs replacing Stone & Glass will part exchange it. The replacement costs between perhaps £3,000 and £7,000 (depending on the condition of the spindle being replaced) instead of more than £15,000 than a new one on its own costs. The old spindles are returned to CMS to be refurbished.

Stone & Glass says that among the Sasso machines the K600 saw with a concrete bed has proved popular among stone companies in the UK, although the best sellers are still Sasso’s edge polishers.

The concrete bed of the K600 allows inside corners to be cut square using a plunge cut. And the disc cutting through the concrete bed has the advantage of cleaning the diamonds.

Bruno Machado of On Point Engineering will be in Verona supporting the French stone machinery manufacturer Thibaut, whose products are among those sold by On Point in the UK.

Thibaut is another company keeping the wraps on a new product it says it will be launching at Marmo+Mac this year.

Whatever that might turn out to be, the company says it will also be showing its T952 five axes multi-function saw-cum-workcentre, its T812 miller-router and the TWJ 3317 waterjet.